Silicone blown

It's not good when "contagion" is the word of the day. You'll often hear the adjectival form, "contagious," used in a positive way – last night I heard an honoree be told that her smile and enthusiasm were contagious – but the noun form never refers to anything good.

Today it's being tossed around with regard to the two American banks that went under in the last few days. First Sivergate, and then Silicon Valley Bank. They've both been shut down, and people with money on deposit in either institution can't get at their funds. Up to $250,000 in each account is guaranteed by the federal government, and apparently that much will be available tomorrow, but it's reported that around 90 percent of Silicon Valley's accounts are greater than that.

How much money is unreachable over the weekend? At the end of last year, Silicon Valley's deposit base was reported to be around $175 billion, and Silvergate's $6 billion, but those numbers have likely shrunk quite a bit after recent runs on both banks.

To put this in perspective (if that's possible), Silicon Valley, with $212 billion in assets last quarter, is the second-largest American bank to fail in modern history. The largest was Washington Mutual, which had roughly $300 billion just before it collapsed.

What went wrong this time? Part of the problem is cowboy behavior on the part of the banks' managers. Silvergate in particular was up to some wild stuff with the crypto birds. But I think the main problem is not crypto; it's incompetent banking. Interest rates shot up over the last year or so, and the banks had their money tied up in long-term bonds paying a low rate of interest. Because the market is paying a lot more to borrow money these days, bonds with low-interest terms have gone way down in value.

Now, if you hold onto a low-interest bond for many years until it matures, you get all your money back, along with whatever puny interest you earned. But if you need cash in the meantime and have to sell off the bond, no buyer is going to pay you what you paid for it. You sell at a loss.

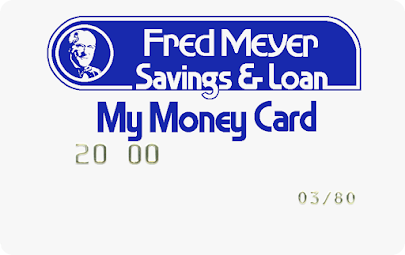

People with money in Silicon Valley got spooked this week, and some big hitters pulled out their deposits. Silvergate had run into similar trouble around the first of the year. The banks had to come up with a lot of cash in a hurry. So they started selling their bonds at a loss. It quickly became clear that if they kept going at the rate they were selling, they wouldn't have enough to pay all the depositors who wanted out. That's when the regulators came in and shut the doors, at least until tomorrow. Some people are analogizing to the 2008 financial crash, but to me it seems more like what happened to the good old savings and loan associations that were wiped out by interest rate swings in the early 1980s.

Right about now is when the stealing starts. Somebody like a Jamie Dimon at Chase, the ultimate corporate Democrat, will come in and offer to buy, say, Silicon Valley, for a fire sale price. One back-handed way or another, the federal taxpayers will throw a bunch of money in, the troubled bank will be saved, all deposits will be honored, and Chase will make a bundle. That's pretty much the best-case scenario.

There's a report floating around that Elon Musk wants to buy Silicon Valley. TwitBank, as it were. You would hope that the regulators are smarter than that.

Anyway, another distinct possibility is that the government won't be willing or able to pump much money in, no dirty-white knight will come forward with a workable deal, and uninsured depositors will get only, say, half their money. A lot of businesses fold when half of their cash on hand disappears. And they'll have to wait for their crumbs. Wednesday is the 15th, payday at a lot of places. Places like tech startups and wineries. Will employees of the banks' customers get paid?

Even if a quick rescue of Silicon Valley occurs, it's hard to believe that there aren't other banks in the same position. All it takes is one panicky post by an influencer on social media somewhere, and a run on a bank can start. The facts about interest rates and bond values aren't pretty, and there's no way around them. This could be the start of something big. Let's hope not, but I wouldn't bet on this story winding down quickly.

UPDATE, later that day: Things are moving quickly.

Bragging about ESG and ignoring good banking principles should have been a warning.

ReplyDeleteHalf right.

DeleteHard to see how ESG had anything to do with it. But hey, everyone will make whatever political hay they can out of it. "It's all Biden's fault, he's senile." Okay.

DeleteThe CFO of Silicon Valley Bank should be permanently barred from ever working again as an officer of a publicly held company. Jerome Powell, the Fed Chairman, has been warning for over 18 months that interest rates will be on the rise. SVB ignored these warnings and continued to hold a significant position in long-term government debt even after the position began dropping in value due to the higher rates. Financial malpractice and just plain dumb.

Delete