Highway robbery. Literally.

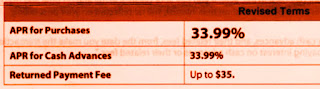

Yesterday my good friends at Synchrony sent me a little two-page letter explaining to me that there will be some changes to the terms and conditions of my credit card account. You know, the fine print that you don't read. But it was pretty hard to miss this part:

Wow, just wow.

Now, I don't have to carry credit card balances of any kind any more, thank goodness, but I sure feel sorry for the guys and gals who do. Here they are, in rough enough financial shape that they need to borrow money to get gas for their car, and how much do they have to pay? If they need $100, it's $34 a year.

Synchrony Bank, a 21st Century loanshark. Even worse, really. For shame.

This kind of thing could be reined in by Congress, if it wanted to. Outrageous interest rates used to be outlawed by state usury laws, but Congress pre-empted those many decades ago with the help of the Supreme Court. For all the preaching about wealth inequality by the Elizabeth Warrens and Ron Wydens, the politicians go right along with the gouging. Because their wealthy donors like that freak Jamie Dimon are the bankers. Shame on all of them.

Don’t think you should throw rocks at the court for this. It was the hundreds of millions in lobby money laid on the lazy congress

ReplyDeleteSynchrony Bank President: Brian D. Doubles.

ReplyDeleteAs outrageous as this is for gas, imagine medical bills with this interest rate.

ReplyDeleteJesus was not a big fan of the money changers.

ReplyDeleteBy my calculations, the highway robbery being committed by that bank is even worse than you described. If you charged $1,000 on your credit card issued by them today and then paid nothing on it for the next year (365 days), you'd owe them $1,404.62, for an effective interest rate of 40.0%. This calculation doesn't include any late charges they'd undoubtedly levy along the way. The higher Effective rate is because they are compounding their 33.99% interest rate on a DAILY basis. It used to be more customary to do this on a monthly (billing) basis. This sort of garbage should be outlawed, but like you wrote, the banks have too much power for that to happen. Ron Wyden, Chairman of the Senate Finance Committee, is asleep at the wheel, and probably hunkered down some of the time on Jamie Dimon's yacht.

ReplyDeleteIt’s amazing how easily the defaulting of an obligation gets excused.

DeleteOops, I think the effective interest rate is 40.5%, not 40.0%. I was tired.

DeleteSynchrony Bank is also the outfit that backs horrible interest rates on retail credit accounts like you can open at Home Depot or Lowes. I'm not surprised they would also be grifting in fuel credit markets too.

ReplyDelete