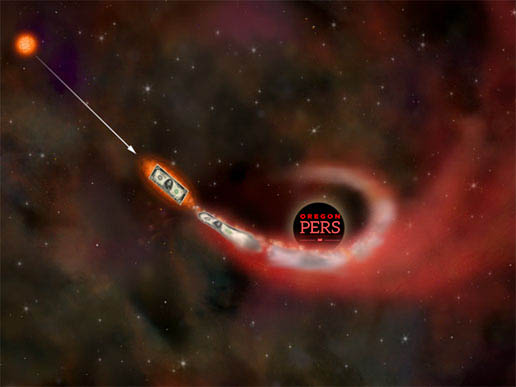

The black hole intensifies

Ted Sickinger, the reporter at the O who best understands money, has a howler of a story posted here. The Oregon public employee pension system lost money on its investments last year, despite the projection, under which it operates, that it would make a 6.9 percent profit. Its actual profit for the year was negative 1.55 percent.

So now they're setting their expectations for the future, and over the course of 2023, markets continue to be lackluster. The pension fund says it made 3.9 percent through August, which might pencil out to about 5.5 percent for the year, but once again, the folks in charge have chosen to budget for 6.9 percent. And these are percentages of extremely large numbers.

Sheesh. If you and I ran our personal finances the way these guys run the public pension money, we'd be looking for a good parking space for our bombed-out RV somewhere within walking distance of the Sextant Bar.

When the pension gurus don't make budget, the various levels of government have no choice but to pay more tax dollars into the system, which means less money available for public services. We've been warned for a few decades about this, but now the problem is visible. When you drive around Portland and wonder why there's no money to stop the gang violence, clean up all the hideous graffiti, bust the drug dealers, house the homeless, and give out tickets to the many lethally dangerous drivers, a big part of the answer is that the taxes are going to pay retired bureaucrats, cops, bus drivers, firefighters, and everybody else who once appeared anywhere on the public pad. (Except the Portland police and firefighters, who have their own "system," under which zero has been put aside for their pensions. That's right, zero.)

As Sickinger knows and has been trying to tell Oregonians for a long time, the situation has been getting steadily worse for more than a decade now, and the people in charge have been thinking magically and pulling the public's leg. If you don't like the looks of the place now, you definitely aren't going to like where it's going next.

In the private business sector, employees don’t get rewarded for doing a sloppy job and often get discharged when they constantly screw up.

ReplyDeleteWish public employees were treated the same way.

The problem is long term and already-retired employees. Tier 1 was crazy, and based on extravagant predicted returns. When that turned into a crises, Tier 2 was invented, and even it was too expensive. Now, employees hired after a certain date get Tier 3, which is an awful lot like a 401K plan. It is expensive, but compared to the 1990s, not so bad!

DeleteIt may be messy, but why not declare PERS "bankrupt"?

ReplyDeleteMaybe the state could spin off PERS as an independent entity. Probably would have to make it solvent on paper first. Maybe we could give them Crater Lake or 100 miles of public beaches.

DeleteDon't worry the filthy rich have all sorts of plans to kill us off and they even have progress dates, like 2030. Life insurance companies have been paying out a whole lot more above average in just the last few years.

ReplyDeletePsychobabble

DeleteWhy not just tax PERS Teir1 income at a special rate to claw back the nonsense? Retired football coaches get a special 1000% tax rate. Out of state residents the same.

ReplyDeleteShould cut all PERS benefits 1.55% to match the loss. Sadly, that will never happen.

ReplyDelete