Oregon opens tax hall of shame

Here's a wild one. The Oregon Department of Revenue has posted on the internet a list of taxpayers who are delinquent in paying state taxes of $50,000 or more.

The Oregon Legislature passed Senate Bill 523 in 2019, authorizing DOR to post information online about delinquent taxpayers whose tax debt was more than $50,000.

DOR delayed the first planned launch in March 2020 out of concern for possible financial hardships for taxpayers created during the COVID-19 pandemic.

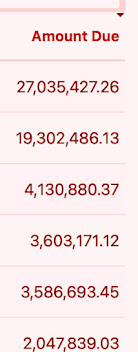

For each alleged deadbeat, you can see how much they haven't paid, and what kind of taxes they haven't been forking over. You can also filter the list to look for specific people or companies, among a few other searches.

I was a little surprised at how many of the delinquent taxpayers are in the construction industry – having "Construction" in their name – and how much of their tax debt is for withholding. I assume this means these are employers who withheld taxes from their employees' pay and then didn't pay them over to the government. And if they're this deep into it with the State of Oregon, you can imagine what the situation is with the federal IRS.

Cannabis makes a big showing. And there are some lawyers on the list, too; one mediator shop is listed as owing $195,000, most of it withholding.

There are folks from all over the country on the list, but only one New Jersey outfit: Edwards Vacuum Inc. of Parsippany, shown as owing $558,000 in Tri-Met payroll tax. That's quite a payroll. Go figure.

I wonder if this information, now public, affects any of these people's credit ratings. I wouldn't be surprised if it didn't. There's probably more consequences when you stiff Visa than when you stiff the tax people.

Anyway, see what fun you can have with the hall of shame. But remember, these are just the tax deadbeats that the Department of Revenue knows about and that aren't making payments. The underground economy, and people with installment arrangements, don't show up.

The Nike-shoe-reseller kid in Eugene, representing at #2.

ReplyDeleteThe Shilo Inn guy is quite the piece of work also.

DeleteWhat should I do for my friends who made the list? Send a framed copy? A sympathy card? Venmo?

ReplyDeleteThis isn't very user friendly. The list isn't linkable; it isn't sortable; you can only view about 5% of the list at one time; getting "detailed information" about each taxpayer is time consuming. Did they deliberately make this hard to use for some reason?

ReplyDeleteI've downloaded the entire list and put it into an Excel file that solves the first three problems at least. Those who care can download the file from https://ti.org/docs/OregonTaxDelinquents.xlsx. My file also includes the order in which the taxpayer is listed on the DOR's list. Divide by 100 and add 1 to get the page number it is on (e.g., taxpayer 405 will be on the 5th page of 20).

By the way, we can calculate that these delinquent taxes add up to just over $330 million. That's a lot from an individual standpoint but perhaps not much from the state's standpoint, not that this excuses any of them (except for those avoiding paying the TriMet or other transit taxes; they should always be excused).

Once you stop sending your collected payroll taxes to the taxing authority, your business is in a death spiral.

ReplyDelete