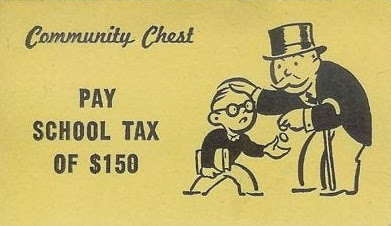

How bad are taxes in Portland, Oregon?

Take it from these folks. Taxes here are beyond bad.

Negative perceptions around Oregon’s tax climate have arisen due to the passage of multiple new tax measures, at both the state and local level. A 2020 study by the accounting firm Ernst & Young, conducted on behalf of the Oregon Business & Industry Foundation and the State Tax Research Institute, found that the cumulative statewide tax business tax burden in Oregon is set to rise 41% because of new taxes passed by the 2019 Legislature, while a business based in Portland was set to experience another 23% increase because of increases in local taxes. The full report can be found here.

Statewide taxes include the new Corporate Activity Tax, which took effect in 2020, an increase in the tax on insurance premiums, and a new Paid Family and Medical Leave tax, which will take effect in late 2022. Local tax increases include property tax levies (Metro Housing Bond and the Portland Parks Levy); the Portland Clean Energy Surcharge (PCES); an increase in the Multnomah County business income tax (BIT); taxes associated with the Metro Homeless Services ballot measure passed in 2020 (business and personal income taxes); and the Multnomah County Preschool for All personal income tax, also passed in 2020.

The increase in tax incidence to households and businesses, coupled with the impacts of the Covid-19 pandemic, have set the region on a path of increasing unaffordability. The survey demonstrates that Oregon is at a tipping point arising from burdensome taxation and now risks harming both its near-term economic recovery, as well as longer-term business retention and economic development efforts.

Go ahead, hipsters, keep on voting in every new tax anyone can come up with. "Eat the rich!" You'll soon be living on the set of a doomsday movie. "End civ!" You are doing a great job.

Local and state government are creating a vicious cycle here. Taxes are going up, while basic services that help to promote a viable business environment are almost non-existent.

ReplyDeleteI am no nuclear brain scientist, but even I, a lowly peasant, can see that this is all a recipe for economic disaster somewhere down the road.

The straw that will break the camels back might be the next new proposal

ReplyDeleteThe estate tax in Oregon is outrageous as well.

ReplyDeleteI offer no defense of Oregon’s tax system, which taxes the things we most want the economy to give us and fails to tax many or most of the things we should most discourage. It punishes people who invest in improving their properties to the benefit of all but making them pay higher taxes, rather than taxing people who are sitting on valuable properties for speculative purposes. And it is designed to be and is easily gamed by those with the wherewithal to do so, so it is far more regressive in practice than it appears to be on paper. Bottom line, you can write books about what’s dumb about Oregon’s tax system.

DeleteBut the complaints about taxes have only increased as the tax burden has overall dropped. What has happened is that 70-80 years of concerted effort to convince Americans that we are overtaxed have succeeded and thus, even though the tax burdens on individuals are vastly below where they were when the campaign began, the level of grumbling about the taxes is much much increased.

So again, no defense of a complex, Rube Goldberg welter of this and that taxes, each with its own bureaucracy and exemptions and what not. But, overall, even the wealthiest amongst us are very very lightly taxed (actually, especially the wealthiest amongst us).

“the wealthiest among us” are the ones that make things happen. That’s where revenue and employment get started.

ReplyDeleteThat's what Ronnie Reagan and David Stockman were peddling before Stockman got taken out from OMB to the woodshed for telling Bill Greider the truth about "the hogs feeding at the trough." We've had 40 years of disinvestment in America based on the idea that if you just feed enough cherries to the rich, the rest of us will be hip deep in cherry pie before long. And it's an absolute scam. We've hollowed out the middle class and now have huge numbers of folks who spend all their time begging for tax breaks, profiting from tax breaks, and hiding the ill-gotten gains from tax breaks, while doing nothing that builds actual value. The comment about the estate tax is typical of the mentality -- the idea that it's outrageous if someone can't inherit their way into the never have to work elite is a huge part of what's wrong with America. We have it set up so that vast dynasty fortunes are accumulating again, with a complete step up in basis with each generation, so vast fortunes are growing without ever being subject to any tax at all. The rich have definitely made that part happen.

DeleteNever had any respect for Engels or his buddy.

DeleteWell you can shove your redbaiting next to your brain stem and go join the black bloc idiots with their “End Civ” signs with your “Taxation is Theft” sign.

DeleteToo much accumulated wealth is transferred via the current step-up in basis. It should be taxed at some time during the life of the taxpayer, or on the taxpayer's death. Treating these transfers as sales is appropriate. If you want a kinder, gentler solution, the recipient should get it with the basis the decedent had immediately before death.

DeleteHappy to have bailed out last January and moved across the Columbia. Things are perfect but they are a whole lot better than in Portland and my rough guesstimate is an overall tax savings even after purchasing a car.

ReplyDeleteQuit pretending it’s the hipsters who are responsible. Homeless Services Tax was endorsed by the Portland Business Alliance. Preschool for All got a whopping two-thirds of county voters.

ReplyDeleteIf the relocation continues, those 2/3s will have plenty of agreeable company.

DeleteBetween the hipsters and the MBAs, it's all moot. They both can demand what they want, knowing that if things get too bad, they have the wherewithall to move someplace else and start the cycle all over again, leaving everyone else to deal with the mess. (It's now a joke in Austin and Dallas that no public "improvement" project proposal is so stupid or so impractical that you won't get at least one pencil-necked beardo from a rich family in Plano or Allen popping up and bleating "Well, they did it in Portland when I lived there...")

Deleteof course it got 2/3 of the vote! It imposed a new tax on, what, 10% or so of the voters? That's easy to get done....and cowardly, of course. shame on Metro and City of Portland.

Delete