Wall Street Nouveau

I get a lot of junk mail here at Blog Central. It's a pain to deal with. I feel compelled to shred anything with my name on it, and that stuff piles up. Medicare plan come-ons are a big category at my age. Pitches for extended warranties are also plentiful. The electric company wants me to pay extra for "green." At election time, political porn fills the mailbox. And money appeals from all kinds of charities add to the bucket loads. Anybody I ever gave a nickel to shows up in the snail mail from time to time.

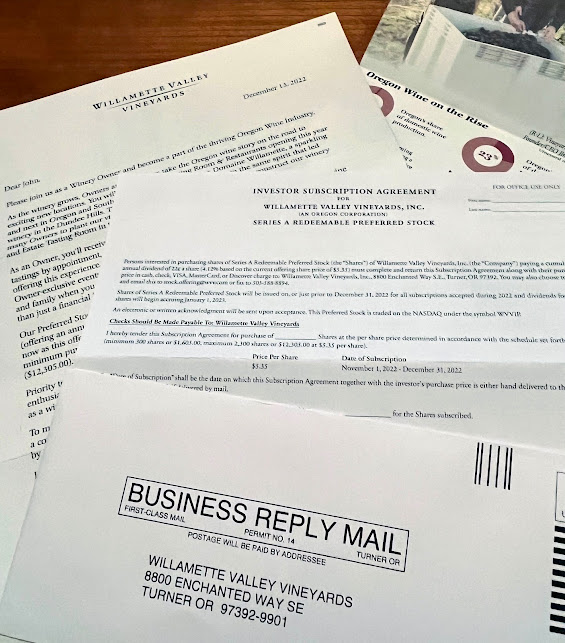

But I must say, the pile doesn't usually include an offering to buy stock of a public company. Until last week, that is, when I got a four-sheet package from Willamette Valley Vineyards, offering to sell me shares of its preferred stock:

It even included a subscription agreement that I could fill out, sign, and send in. Don't forget your check or credit card information.

How times have changed. When I was practicing law 40 years ago, an offer to issue stock was an agonizing process, almost a sacred ritual, carried out only through brokers, and limited to investors who had enough money that most of them could be assumed to know what they were getting into. Nowadays, you just download an app on your phone and any Tom, Dick, or Harry can be off and running, gambling away. In the current loosey-goosey climate, I guess a direct-mail public offering, to a mailing list of people who once bought wine somewhere online, doesn't seem so out of place. But the old lawyers I used to work with would faint if they saw it.

Way down in the fine print, the mailing cautions us to read everything the company has filed with the SEC. And in signing up, the investor swears:

I have both knowledge and experience in financial and business matters, and have had the opportunity to consult my own legal, tax and financial advisors who are capable of evaluating the merits and risks of my purchase of the Shares. I have conducted such examination of the Company's business, financial condition, results of operations and other relevant matters as I deem appropriate. I have reached an informed and knowledgeable decision to acquire the Shares, independent of any representations of any persons connected in any way with the Company. No party has made any representations to me as to the profitability, if any, of the Company, nor have I relied on any statements made by any persons concerning the value of the investment in the Shares or the risks associated therewith.

But nowadays, for a lot of people, I'll bet all the fine print, including this paragraph, is like the Terms of Service for phone apps or computer software. People click "Accept," but have they read any of what they're accepting? In this case, Willamette Valley is seeking an investment of between $1605 and $12,305 per investor. Not everybody has that much jack lying around, but those amounts are certainly not so large as to guarantee that the buyers know what they are doing.

Anyway, I will be passing on this opportunity. As I understand it, for an investment of $5.35 per share, you get a dividend of $0.22 a year, or a 4.11 percent return. Dividends have to be paid to the preferred shareholders before the common shareholders get any; that's why they call it preferred. But the $0.22 a year is all you get so long as you hold your share. And if times get really tough, the company doesn't have to pay any dividends. Stock is not an IOU.

You can take your dividend in wine, in which case you get an extra 15 percent, which I take to mean you get $0.253 per share, or a 4.73 percent return. As a shareholder, you also get several other perks around the winery and its tasting facilities. And from what I gather on their website, shareholders get good discounts on wine all year long.

One interesting feature of the stock is that it's "redeemable." The company can get rid of you at any time by buying out all the preferred shareholders at $4.15 a share. Similarly, in the event the company liquidates, $4.15 is all you get.

For me, the clincher is that according to Yahoo, you can buy this preferred stock right now on the open market, and its closing price yesterday was only $5.08 a share. It hasn't traded at $5.35 or better since March. (At one point late last year, it hit $7.51. Over this past summer it dropped to $4.15.)

If you buy a lot of wine from these guys, the discounts alone are probably worth it. But as a financial play, it's definitely not to my taste.

As I toss the mailing into the round file, I have to note that many wine enthusiasts disagree with my call. As of the end of September, there were 8,483,862 shares of this preferred stock out there, which was 960,323 more than at the same time the year before. They've been at this for quite a while, and people, it seems, are into it.

Your mileage may vary. Don't take it from me. Like the man says, see your own legal, tax, and financial advisor. Or your sommelier.

I keep up a little with the vineyard community, especially the attempts to give Texas wines a better reputation than they had back in the 1980s. I'd stay far away from investing in vineyards for multiple reasons, including overproduction (a lot of chardonnay vineyards bought by more-money-than-brains techbros in the 1990s were bought out by others after they flooded the market in the early 2000s), skeevy bookkeeping, and the honest reality of the individuals who appear to be wine geniuses when the market is good and people will drink anything who turn out to be wine idiots when the market corrects and they actually have to make a profit. Far too many of the owners I've met, to steal from the political writer Charlie Pierce, can't be trusted to cut their own meat.

ReplyDeleteOur financial advisors say, “no vineyards, no horses, no airplanes, no yachts” for investment purposes.

ReplyDeleteAnd you sure as hell don't invest in a vineyard that informs you of their investment opportunity via bulk mail. This whole thing screams "We're hoping that nobody bothers to check on the status of their contributions until the heirs are going through the papers and we're all dead."

DeleteI gather this is still a Jim Bernau enterprise. He was earned a lot of recognition in the wine industry as an entrepreneur. According to the internet, he earned more than $500,000 a year. I wouldn't buy his stock as an investment; only if you like his wine. I'm sticking with Charles Shaw.

ReplyDeleteA taxable 4.11% return and that isn’t guaranteed to boot — all while Series I savings bonds are paying 6.5% for as much safety as there is to be had in this vale of tears (it was nearly 10% for six months earlier).

ReplyDeleteTheir plonk is meh at best. Grapes grown beside I-5?! No thank you…

ReplyDeleteOnce upon a time, a public offering required a lot of expensive legal/bureaucratic work before getting government approval for an offering.

ReplyDeleteI don’t see that here