The lottery winners

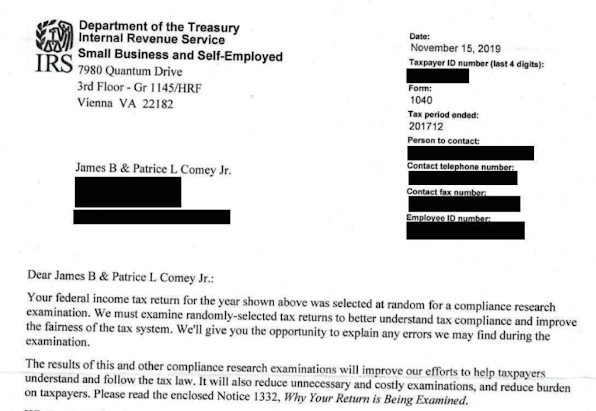

The news today includes a fascinating story about how two of the FBI directors that Orange Caligula hated most when he was President both got audited by the IRS after he canned them. The suspicion is that Trump, or his last appointee as commissioner of internal revenue, Chuck Rettig, sicced the tax auditors on James Comey and Andrew McCabe out of spite.

The audits in question were not based on anything in either man's tax returns. They were part of a longstanding IRS program that picks tax returns out at random for examination so that the government can track taxpayer behavior across the spectrum. These audits are not designed to collect revenue, and in the cases of Comey and McCabe, they reportedly yielded next to nothing by way of tax deficiencies. The point is to collect information and compile statistics on patterns of taxpayer compliance (and non-compliance).

The sampling is small. The chances of being audited under this program are like those of being struck by lightning. But in this case, the lightning struck twice in nearly the same place.

The type of audit the two former FBI chiefs underwent, two years apart, is particularly hellish for the taxpayer, because the IRS agent typically demands to see proof of everything on the return. They'll want a receipt for every single item deducted. It's a full-on game of "Who had the pickle?" and it drives tax professionals and their clients nuts. I remember a client of my old law firm who underwent one of these 40 years ago. In those days these audits were called TCMP, which as I recall meant the Taxpayer Compliance Measurement Program. You couldn't settle with the auditor to make her go away; she wasn't there for the money. She was there for the data. Ninety-nine cents for a box of paper clips? Let's see the receipt, please.

Although Comey and McCabe didn't owe a bunch of taxes, surely they got socked with some painful fees by their accountants over this. And so they were damaged to that extent.

What does the IRS do with the data it collects in these examinations? It uses the information to help it set up the algorithms that are used to select returns for real audits, the ones that are aimed at catching cheaters and collecting money. Those algorithms are top secret, and they have to be, or else the tax system, already badly gamed by people of wealth and creepy tax shelter promoters, will be gamed right out of existence.

Which is why this week's news is particularly troubling. Once again stumbling around on the defensive, the IRS will be tempted, or forced, to discuss publicly how it picks out tax returns for audits. That kind of public airing is extremely bad for the system, and by extension, extremely bad for the country.

But it sure seems crazy that two FBI directors hit the lottery so close together, and so it's absolutely justified for the sleuths in the Treasury Department inspector general's office to take a hard look and make sure that no hanky-panky went on. Richard Nixon used the IRS as a weapon against his enemies, and in the wake of his forced departure, laws were passed that make it a crime for an IRS employee to take action against a taxpayer for political reasons. We need to be sure that those laws were not broken here.

Do you think they were?

As somebody who sits in front of a computer day after day studying the federal tax system, let me offer my two cents. The chances of Rettig, the commissioner of internal revenue, being involved in choosing to audit Comey and McCabe are slim to none. Rettig is a straight shooter who would quit before he would do anything of the kind.

But could some lower-level functionary at the IRS have decided to have some fun at Comey and McCabe's expense? And could somebody from the Trump White House or elsewhere in the Treasury Department have suggested it? It's certainly possible, although I'd put the chances of that at something like 80-20 against.

In short, if I had to bet, I'd say it was a coincidence. And coincidence or not, the people in Congress who are calling for Rettig's head are blowhards. If there's corruption in the ranks at the IRS, firing Rettig isn't going to help. Quite the opposite.

But by all means, inspect away, G-men and politicians alike. My only request is please, don't beat up the tax system any further over it. It's already hurting pretty badly.

If the audits were conducted for the same tax year, I’d say they were sicced upon.

ReplyDeleteBut two years apart? Seems coincidental.

Although some would say the two-year separation is in itself evidence of malice and conspiracy.

Trump is still living inside the heads of too many people.