Now I can retire

I was more than a little surprised the other day when I spied an envelope in our mailbox from the IRS, addressed to the Mrs. and me, with what obviously was one of their colorful checks enclosed. Surprised, because we're among the lucky people who get to write a check to the IRS every year, not vice versa. We haven't gotten a tax refund in many a year.

One time we did get a big refund check, but it was a mistake. When they were retyping our numbers into their computer, somebody at the IRS had made a big typo. I called them, which is rarely a productive move, but at least in those days they eventually answered the phone. The guy I got on the line insisted that I should file an amended tax return, which of course was the totally wrong advice. I wrote "VOID" on the check with a big black marker and sent it back with a short letter explaining. I never heard anything more about it.

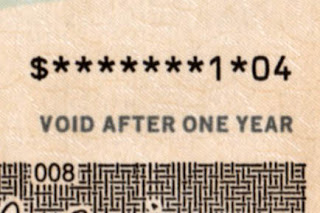

Anyway, this time around, when I opened the IRS envelope, I realized that the refund was in fact correct. Ridiculously correct. The check was for a $1 of overpaid tax, plus 4 cents interest.

It all made sense, sort of. Back in April of last year, I filed for an extension of time to file a complete tax return for 2020. When filing for the extension, I paid what I knew we owed, but I bought some time for actually filing the return. In October, I finished the return and mailed it in. As it turned out, back in April I had overestimated what we owed by a big fat $1. Once I mailed the return (the postage was probably around $1), I promptly forgot about it.

That was in October. It's eight months later. The IRS must have just gotten around to processing our return in the last couple of weeks.

Anyway, since we paid the extra dollar last April, we get a year's worth of interest, 4 cents. Whoopee!

Now, of course we're going to cash the check. But what should we do with the $1.04? Suggestions welcome.

I'm still mad about the $2.96 the City of Portland nicked me for. But that 4 percent I earned on a short-term Treasury obligation during a time of record-low interest rates was a nice windfall. If only they had owed us a million.

Well, obviously the IRS respects and fears you. So when you move to Washougal, before taking over local government, could you please throw your weight around enough to overcome the Intuit lobby and get pre-completed tax forms made law so that we join the advanced countries that send their taxpayers a completed form at the start of tax season using info the IRS already has, so you can just sign and return if it's all right, or add to if there are changes needed. You could attain sainthood if you can get it done.

ReplyDeleteI agree 100%. But anyone who tried that would be attacked ruthlessly by the Intuits of the world, H&R Block, etc. Those guys play rougher than you might think.

DeleteAnd right now the IRS is so understaffed, it would be a disaster. Who's gonna get the money together to get it done? Ron Wyden, the genius running the Senate Finance Committee? Don't make me laugh.

When are we going to mount a campaign to get rid of that slush fund called the "Arts Tax"?

ReplyDelete