Tax Day in Portlandia

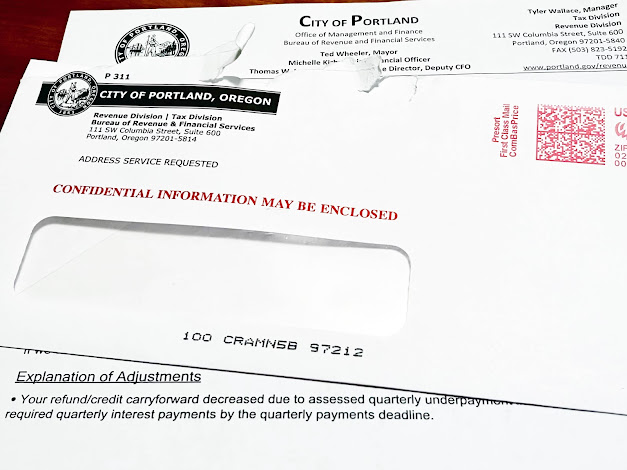

It being Tax Day (except in Massachusetts and Maine, where it's Patriots Day), every news organization in the country has a tax story or two on the wire at the moment. I'll add one to the pile. Mine is another tale of the outrageous, hyper-aggressive behavior of the Portland City Hall tax collectors. This one just showed up in my mailbox the other day.

They're dinging me for $2.96 on the ground that I didn't make my quarterly tax payments on time. (I have to make quarterly payments of city and county business income taxes because I wrote some books and collect royalties.) They spent 43 cents in postage, several cents for a piece of paper and an envelope, and God knows how much in worker time, to nick me for $2.96 out of my refund. A refund of my money that they've had for a year now.

They don't say which payments were late, or by how long. But it can't be more than a day or two for a payment or two. For this, they have to rub my nose in it.

The feds don't conduct themselves this way. The state doesn't conduct itself this way. This is all City of Portland acting-out.

Now, first of all, I don't recall my payments being late. With the exception of the December payment (the city's is due a month earlier than everyone else's), I put my Portland blood money in the mail at the same time as my federal and state blood money. I've never been accused of tardiness by the IRS or Oregon. Never.

And secondly, if the city is so darn hot about the time value of money, they sure don't act like it when it comes to opening my envelopes and cashing my checks. My April 14 check cleared my bank on April 26. The September 15 check didn't clear until October 6. The December 15 check? January 6.

But the richest part of the whole experience is this bureaucratic middle finger:

Could Kafka have done it any better?

I think we need a Local Taxpayer Bill of Rights here in Oregon. The City Council can't be trusted with such a thing; it needs to come from Salem. Maybe Betsy Johnson could get it done.

Meanwhile, if you're crazy enough to open a business in Portland, be prepared to deal with the snarling pit bulls at City Hall. They bite.

We moved out of Portland last year well before incurring any state or local tax liability. Except for the arts tax. According to the city, if you spend a single day as a resident, you owe it. We're not going to pay it. It will be interesting to see if they come after us.

ReplyDeleteVantucky P.O. box & little shell corporation it is?

ReplyDeleteI'm kinda at that point with this BS?

Sold stuff outta state in the past only a few weirdos read/buy/hardly any real $/just a hobby, have no foot traffic. Why bother other than reverse commuting/central location/proximity to *some transit* & hospital options & glut of commerce being here in this corrupt grubby little cesspit?

For under $20k / 200 transactions a year as a hobby not having to declare a cost basis for all this weird old junk that is water 10-20 years under the bridge/hardly 'new' or 'profit making' is hardly worth it on the fed level.

That said, I concur with you with the IRS, for the most part they & tax pros have been helpful & straight forward & eager to receive what you can pay now without coercive entrapment.

Federal 'pound me in the a$$ prison' (as they say in Office Space) still scares the hell out of me as they along with the tactics of other Fed. 3-letter agencies if you get on their 'bad side' but the IRS/dept of treasury has a basically impossible mandate & other agiencies like the Fed. Reserve have taken power/resources away from the Dept. of Treasury & given them fewer resources to meet their mandate & collect income tax that only used to apply to the uber weathy to fill out forms & paperwork in ~1911 when the federal income tax was even established.

Granted, we had free real estate from all the natives that died & all the territory we swallowed from the spanish a few years before up to that point with incalculable resources to exploit, whereas other countries that wasn't so true in 1911 to allow for basically no tax burden/load on their population, but I digress...

...nor did we have the complexity/standard of living/infrastructure we've grown accustomed to that's all now crumbling/not really/never really was sustainable, either?

At what point are you saying 'no good will come of this' for every little petty good fellas 'F-U, pay me' cali criminal/portland criminal extortion reach racket to even crack the door/dignifiy this with a response?

Tho lake oswego & beaverton have plenty of their own of that?

My roommate is deceased recently (thats a heartbreak story for another day), just been using his name with a money order with a payment stub that I keep with the arts tax memo? There's 1 resident alive at this residence & I'm being honest about that with a paper trail & matching serial # money order stub I keep & track to see if they cash it.

I'll sue them or have the fully automatic shotgun ready to go if if they dare force the security gate open!

eff em, I dont trust those A-holes with the stories of them 'losing' peoples SSNs & claiming they never received arts tax payments.

Don't wanna live in the 'couve with the other tax dodgers, shyster contractors in that layout with the bridge obsticle, toxic algae bloom vancouver lake, shady drinking water, shitty neighbors that will rat you out but won't just come talk to you that also have ugly junk/cars on jackstands/drunken fights (not my thing), higher property taxes (they never really had the property tax revolt under Bill S. like we did here in the early 90s & CA did in the early 70s under Gov. Reagan.).

Honestly don't think the can enforce the arts tax legally & don't think giving them a name & SSN is wise, 'what can one say, I will not obey?'

ReplyDeleteYou'll get your $ that that address has a resident, gestapo house searches &/or defacto poll taxes that exempt ~3 people that make <$950/yr of our now worthless inflated monopoly money on paper (what a perfect BS racket amount) is just a bridge too far what can I say?

On years one's compliant non-filing in the state of oregon (low state of oregon income snow bird in AZ) w/o on books income they seem to leave you alone, but the couple years recently w/Oregon income tax they seem to have a name on the envelope for arts tax/be reaching deeper.

Used to just say 'occupant' on the couple years there was no in-state income filed.

'no good will come of this' / 'once you crack the door'...

The City of Portland is particularly draconian with their slice of the tax pie. That includes penalties that equal the amount initially due.

ReplyDeletePortland reminds me of the old SNL skit about The Change Bank. Instead of making change, they're constantly coming up with new ways to tax you and penalize you if you're not on time. https://www.youtube.com/watch?v=CXDxNCzUspM

The new Pre-School and Homeless taxes add insult to injury. It's not just the taxes, but another $150+ to create and mail the forms. I normally make charitable contributions to PPS, but won't be doing that going forward. The new Pre-School tax and filing cost/mailing is about what I've donated in the past. Now that it's mandatory, I'm feeling less altruistic. With the 10K federal limit on SALT deductions and removal of tax prep deductions, I can't deduct the taxes paid or the tax prep/mailing fee on my fed return. At least I could deduct the charitable contributions to PPS.

Oregon needs comprehensive tax reform. Scrap the income tax for a sales tax, allow uniformity challenges on property taxes, and actually provide services for all the taxes they collect. For those who argue that a sales tax is regressive, the Oregon income tax is very regressive and it's a waste of time. I'd rather pay $108.00 ($8.00 in tax) for groceries every few days (with the tax calculated by a register) than have to waste time collecting expenses, filing, mailing quarterly estimates, etc., for taxes that I can't deduct anyway.

^It really kind of does.

DeleteWA doesn't charge sales tax on groceries anyway?

Exempt groceries & non-luxury household goods & it'd be fine/less regressive?

Sales tax/ VAT the hell out of luxury goods.

Every other adjacent state does that, so it's not like people could cheat?

If you got $50-60K for a brand new status symbol car, my heart bleeds for you...you can afford another 4-5K in luxury goods/VAT tax.

Just no political will. The water bill base rate & paperwork fees are double jeopardy as things called a 'tax' are often broadly easier to claim w/the feds etc.

No easy way to organize for that and difficult to cap/lower an existing tax, using state lotto money for schools/other stuff.

Capital gains tax on non-owner occupy real estate & 2-3 or the last 5 years owner-occupy rule like the feds wouldn't hurt either as well as property tax being higher tier for luxury properties (don't pass the cost onto renters that fall under rent control or smaller landlords that maintain existing/older properties (It's a lot of work/a pain usually).

IDK that I'd abolish the income tax entirely, even though as you say, 9.1%-9.9% is a defacto regressive tax on wages & the wealthy make gains these days, not profits or wages really, but all the little fees/other extra paperwork, ya?

& the tax system has been defacto monopoly privatized basically by now.

$80 car title fee is asinine...it's a freaking water mark document piece of paper?

You're just encouraging non-compliance at that point.

AZ kinda has it more right IMO?

Less paperwork, keep business flowing, higher registration on new cars, higher taxes on luxury goods, no sales tax on luxury goods, reasonable sales tax on all else (~4-5%), 2.7% on income that's much more progressive only for top top earners (IDK if it has a scale for inflation) (up to ~8%?).

New electric cars & hybrids have a flat fee now on registration.

We should abolish the gas tax & flat registration on hybrids & EVs & replace it with a progressive tax on new tires & standardize tire sizing like we used to in the '70s if we want to incentivize people to live where they work & actually drive less & pay per use for their foot print w/more durable long life tires.

Tax heavier on giant SUV tires, old pizza cutter reasonable better fuel economy/rolling resistance mid-size car tires in 165-205 width should carry much lower tax, tires should be more durable/less susceptible to UV rot, flat spots & better quality & re-treadable for the next 40+ years so we don't deforest all of Thailand & Vietnam (that was the major French material interest there, such as there was one; Michelin rubber) & deplete their soil/make SE asians starve for our SUVs & trucks.

All compacts should have only 1-3 standard tire sizes, all midsize likewise, all 1/2 ton & lighter trucks likewise, all 3/4-1-ton trucks likewise, all dually cab chassis medium duty on 16" steel rims likewise etc etc for the weight class, regardless of brand of manufacture of vehicle.

All wheels should be straighten-able & safe steel or stainless alloy ideally instead of fragile aluminum?

WA is livin' like CA did several decades ago thinking the juicy military industrial $ & rate of profit will never decline in some ways.

Ya, no state income tax, but property taxes are higher potentially (no cap in assessment or ways to keep elderly & existing residentsfrom getting priced out in the early 80s like VT did w/incoming new yorker yuppies etc.) & the party can't (isn't likely to?) go on forever there either, IMO?

But you're not wrong; a progressive VAT/sales tax is just so dang much easier to collect up front non-coercively w/less paperwork than a state income tax most times without pissing people off.

God forbid we'd get any competent administration of services without a bunch of administrative dead weight or revolving door administrators selling them out from under us. *cough* Portland Water Bureau. *cough*

Thank you. I didn't want to go off on an extended rant, but you caught a lot of other issues and things that are done differently and/or better than other states. I'd love to see a VAT (say 35%) with exemptions for some people (seniors/students/poor) and items (food/first $100 clothing).It could be done with an ID card that has a limit of how much can be bought per person. The 35% would get trickled down to the feds, state, county, and municipality. Imagine not having to deal with the accounting mess. No IRS, no ODOR (an aptly named department if ever there was one), and no ridiculous TriMet, County, and City taxes or their strong-arm collection tactics.

DeletePart of that will be getting people to quit voting for all these taxes that just go into a big black hole. Anybody move into the Metro affordable housing yet? You know, the one from a few years ago that was approved for 1/2 BILLION?

The days of cities and counties being able to tax to the max the income of anyone with a savings account are over. With no SALT deduction, it's over. With homeless camps and trash all over the place, it's over. With high crime rates, it's over. With public transportation raising the specter of infection and all-too-close encounters with drugged-out crazies, it's over. With expensive and failing public services, like schools, it's over. With work-from-home having proven feasible for many, and giving people more living-space options, it's over. Portland and Multnomah County are still under the illusion that they're going to be able to create new taxes to solve all their problems, and it's not going to work for them. The producers will eventually leave for lower-tax locales with better services and lower crime rates. Indeed, they seem to be already leaving, but we'll never get to see the statistics. They'll be well hidden by those with an interest in doing so.

Delete