Who needs riders?

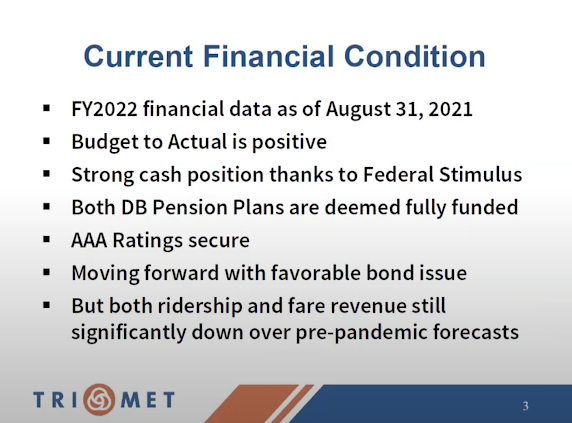

A recent "strategy session" of the comical face cards known as the the Tri-Met board of directors revealed something interesting: The agency is awash with cash, even with no one riding its tired buses and goofball trains.

How do they do it, you ask? It's largely their miserable payroll and self-employment taxes, which suck blood from everyone doing business within a long distance of one of their transit lines.

That tax was once 0.6 percent of payroll. Nowadays it's 0.7837 percent of payroll or self-employment earnings, and rising. Make 50,000 bucks in your sole proprietorship or partnership, send $392 to Tri-Met. Have $100,000 payroll, make it $784. Add as many zeroes to these numbers as you need to make them interesting to you.

Since the financial picture is so rosy, maybe Tri-Met could cut their payroll and self-employment taxes back a bit. But the agency's unelected board, all appointed by the governor and controlled by the many paid bureaucrats planning mystery trains to nowhere, would never entertain such a thought.

Maybe we need a "kicker," where there's an automatic tax cut when Tri-Met fnds itself in a flush position. That would require a change to state law. Be sure to ask Tina Kotek about it when she comes around running for governor.

The scary bullet point above is, "Moving forward with favorable bond issue". And what is going to be backing those bonds? Property taxes?

ReplyDeletePayroll and self-employment tax, I would guess.

Delete