For Wyden, a conflict of interest

The infrastructure bill that passed the Senate last week cast a harsh spotlight on the ethical problems that can arise when the spouse of a member of Congress is actively playing the market for individual stocks. In this case, the member is none other than Ron Wyden, Democrat (sort of) of Oregon (sort of), whose spouse, New York City bookstore owner and socialite Nancy Bass Wyden, has been making many big moves in the stock market over the past year and a half. I've written about them before.

Let me begin this latest story by noting that it involves cryptocurrency, for which I have zero use. Bitcoin, Dogecoin, Ethereum, there are dozens of them – these are digital currencies, powered by blockchain technology and backed by no government, that have become a medium of exchange around the world. To me, they are nothing but trouble, and the government should have been fighting them tooth and nail since they first appeared.

For one thing, the blockchain business sucks up an enormous amount of energy. Bitcoin alone uses about the amount of electricity consumed by Malaysia or Sweden. That ain't helping Mother Earth in her current illness.

But just as important, if not more so, the primary function of cryptocurrency, as suggested by its name, is to hide things. It's as anonymous as cash. Perfect for tax evasion, money laundering, and illegal transactions of all kinds. If your computer is ever hijacked by ransomware, and you decide to pay to get your data back, you'll be paying in Bitcoin.

Now, the folks in government are not quite as dumb as they look, and they're working hard to try to figure out how to cage the crypto beast. They're starting with a tax angle. And that is where Wyden comes in. He is the chair of the Senate Finance Committee, and thus nominally in charge of the U.S. tax system in that house of Congress.

* * * * *

A couple of weeks ago, the long-awaited infrastructure package that had been negotiated between members of both parties came to the floor of the Senate with a fairly innocent-looking provision in it that would give the IRS the power to require "brokers" of "digital assets" to rat out their customers to the IRS, just as stock brokers must do under current law. "Digital assets" are defined, basically, as cryptocurrency. This provision was included in the package at the behest of Senator Rob Portman, an Ohio Republican.

Not too long ago, this language never would have seen the light of day without the Senate Finance chair's blessing, but ever since the Trump tax law was railroaded through in 2017, these kinds of bills come down from the party leadership, and apparently Wyden didn't see this part of the infrastructure bill until it was public. When he did see it, for some reason he really didn't like what he saw. Particularly the definition of a "broker" as applied to crypto: "any person who (for consideration) is responsible for regularly providing any service effectuating transfers of digital assets on behalf of another person."

Remember, this law would leave it up to the IRS to decide who should have to report, and what, as a "broker." The IRS could exempt everybody and anybody. And the new rules wouldn't take effect until January 1, 2024, which would give the crypto lobbyists plenty of time to try to influence what the IRS finally came down with in regulations. But even so, Wyden vocally objected to the scope of who a "broker" could wind up being, and he spent the next week strutting around trying to get the definition in the would-be statute watered down.

Few other Democrats seemed all that concerned, but Wyden was joined in his first bleats by his good Republican friends Pat Toomey of Pennsylvania and Cynthia Lummis of Wyoming. The three of them cranked out an amendment that would let off the hook people and companies "mining" and "staking" crypto, or selling hardware or software. The blockchain industry was delighted. Wyden warned that the original bill would be "discouraging innovation."

Make a note of the hardware part. I'll come back to it shortly.

Anyway, the White House wasn't signing off on the Wyden & Republican Friends deal. And so a counter-amendment was introduced by Portman, "Democrat" Krysten Sinema of Arizona, and Democrat Mark Warner of Virginia. Under their amendment, the definition of "broker" would be narrowed, but some software companies and crypto miners could still be treated as such, required to file reports with the IRS. The Biden folks, who liked the original bill, were okay with this revised language.

Eventually, a compromise between the two amendments was worked out, but Wyden refused to say he approved it. "I don't believe the cryptocurrency amendment language on offer is good enough to protect privacy and security," he huffed on Twitter.

In the end, all of the amendments flopped, because under the bizarre rules of the Senate, they needed unanimous consent, and one of the 100 geezers, Republican Richard Shelby of Alabama, tanked it out of spite because he didn't get his way on some unrelated garbage. And so the original language passed and was sent to the House.

Still, Wyden wouldn't give it up. When last heard from on the subject, he was telling reporters that he would be working to get the language changed in the House.

* * * * *

So why is Ron Wyden suddenly the champion of the cryptocurrency racket? What's in it for his constituents here in Oregon? It's a mystery to me.

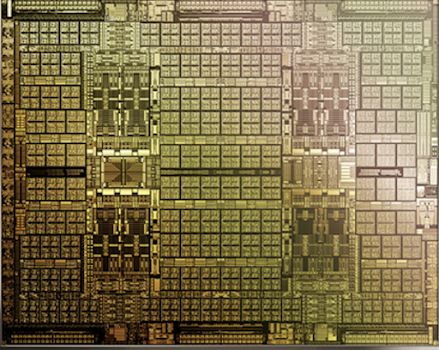

What is not a mystery is that his wife holds a large stake in a company that provides hardware for crypto mining. Over the past year and a half, Nancy Bass Wyden has bought hundreds of thousands of dollars' worth of stock in Nvidia, a company that makes huge computer chips able to handle the load that crypto demands. Originally, Nvidia's products were designed for gaming, but they proved so good for crypto that that became a significant segment of their market. Nvidia now makes chips just for crypto, as well as chips for gaming, and the company's apparently working to keep the two lines separate so as not to alienate the true gamers.

How much stock in Nvidia does Ms. Wyden own? According to the financial disclosure reports filed with the Senate, her stake in the company at the end of 2020 was worth between $500,000 and $1,000,000. Nvidia stock has been increasing wildly in value the whole time she's held it. It recently split 4-to-1. My amateur calculations of the current value of her holdings puts it at somewhere between $765,000 and $1.5 million.

Did this stock market position affect Senator Wyden's actions on the infrastructure bill? You'd like to think the answer is no, but the problem is, you can never know for sure.

Senators' spouses should not be trading individual stocks. Depending on who wears the pants in the family, perhaps Wyden, 72 years old, should retire next year. Then Ms. Wyden can keep raking it in hand over fist, and the rest of us can stop caring.

Comments

Post a Comment

The platform used for this blog is awfully wonky when it comes to comments. It may work for you, it may not. It's a Google thing, and beyond my control. Apologies if you can't get through. You can email me a comment at jackbogsblog2@gmail.com and if it's appropriate, I can post it here for you.